Loans

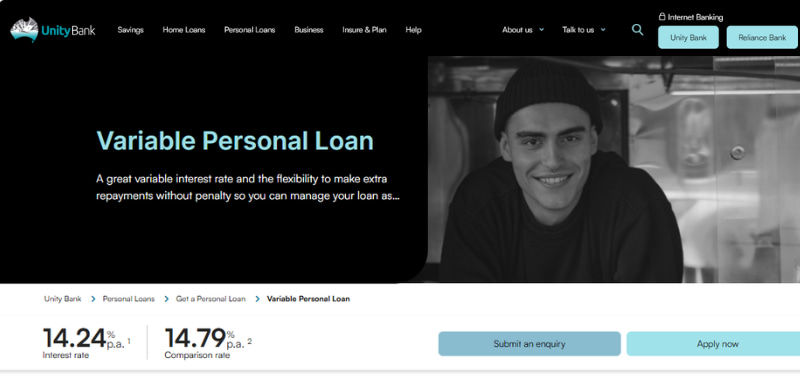

Unity Bank Variable Personal Loan Review: Starting at $500 to fit every need

The Unity Bank Variable Personal Loan offers flexibility and convenience, but how does it stack up against other options? Find out here.

Advertisement

Disclaimer: This loan option has been replaced and is no longer available to new applicants. Check out the Unity Bank website for Fair Rate Personal Loan offers that are available for new applications.

Unity Bank Variable Personal Loan: Giving You the Tools to Succeed

Big plans or sudden surprises? Life has a funny way of keeping us on our toes. The Unity Bank Variable Personal Loan offers a way to take back control—whether that means paying down debt, planning a holiday, or just handling life’s curveballs.

But what’s the catch, if any? That’s exactly what we’re here to explore. From interest rates to repayment flexibility, this review covers it all.

So join us as we take a closer look at whether this loan could be the financial helping hand you’re looking for.

Key Features: Know the Unity Bank Variable Personal Loan

The Unity Bank Variable Personal Loan is a flexible solution for life’s big plans or unexpected expenses. With a variable interest rate, you may benefit from market shifts, potentially lowering repayments over time. Early repayment? No penalties here—pay it off on your terms.

Borrow only what you need, with tailored loan amounts and repayment options designed to fit your budget. Online account management makes it simple to stay on track, giving you more control over your finances without the hassle.

Here’s a concise overview of the Unity Bank Variable Personal Loan:

| Feature | Details |

|---|---|

| Loan Amount | $500 – $50,000 |

| Interest Rate | 14.24% p.a. (variable) |

| Loan Term | 1 – 7 years |

| Fees | – No penalty for early repayments or lump sum payments – Other fees may apply; refer to the bank’s fee schedule |

| Redraw Facility | Available with unlimited free redraws |

| Approval Time | Varies; subject to credit assessment |

| Application Process | Online application available; straightforward process |

Unity Bank’s Reputation and Trustworthiness

Unity Bank has built a strong reputation as a community-focused financial institution with roots dating back several decades.

Known for prioritizing customer satisfaction, the bank consistently delivers personalized service, making clients feel valued rather than just another number.

The institution adheres to industry-best practices and complies with strict Australian financial regulations, ensuring transparency and ethical operations.

Pros and Cons of Applying for a Unity Bank Variable Personal Loan

Making an informed decision about a financial product means understanding both the advantages and potential downsides.

Here, we’ll highlight what stands out about the Unity Bank Variable Personal Loan and areas where it might not meet all expectations.

The goods 👍:

- No Early Repayment Penalties: Pay off your loan ahead of schedule without worrying about extra fees.

- Redraw Facility: Access extra payments you’ve made if unexpected expenses arise.

- Borrowing Range: Suitable for a variety of personal needs, from smaller purchases to larger financial goals.

- Online Management Tools: Manage repayments and account details conveniently online.

- Transparent Loan Structure: Clear terms and conditions, with no hidden surprises.

…and the “could be betters”👎:

- Variable Interest Rate: While it can work in your favor, market rate increases could make repayments more expensive.

- Potential Setup Fees: Initial fees might apply depending on your loan specifics, adding to the upfront costs.

- Limited Branch Access: If you prefer in-person banking, the availability of physical branches may be a limitation.

Who Is Eligible for this Loan?

To be eligible for the Unity Bank Variable Personal Loan, you’ll need to tick a few key boxes:

- Age: Must be 18 years or older.

- Residency: Australian citizenship or permanent residency is required.

- Income: A stable income source, whether full-time, part-time, or casual.

- Credit History: A decent credit record to show you’re financially responsible.

- Documentation: Valid ID (like a driver’s license or passport) and proof of income (recent pay slips or bank statements).

- Loan Purpose: Be ready to share how you plan to use the funds, whether it’s for debt consolidation, a home project, or another need.

Meeting these criteria won’t guarantee approval, but it’ll give you a solid starting point. Got these covered? You’re one step closer to securing your loan!

How to Apply for a Unity Bank Variable Personal Loan

If you think the features of this loan fit your needs, take a look at the application process and know what to expect if you decide to get in touch with Unity Bank.

- Start at the Website

- Visit the Unity Bank website and navigate to the Variable Personal Loan page.

- Click the Apply Now button to begin the application process.

- Fill in the Loan Details

- Specify the purpose of the loan (e.g., personal expenses, debt consolidation).

- Enter your desired loan amount and loan term (e.g., $50,000 over 7 years).

- Select the interest rate type (variable).

- Once done, click Search to view loan options.

- Review the Loan Options

- The system will display tailored loan products based on your criteria.

- Review the details of the available options, including estimated repayments and fees.

- Select your preferred loan and click Apply Now to proceed.

- Complete the Applicant Details

- Provide your personal information, including your full name, email, and whether you are an existing Unity Bank customer.

- Indicate if there are additional applicants or guarantors for the loan.

- Create an application password for security purposes.

- Proceed Through the Steps

- Personal Details: Enter information like your address, contact details, and employment status.

- Your Budget: Provide an overview of your income and expenses to demonstrate your financial stability.

- Final Steps: Confirm your eligibility, review the terms, and submit the application.

- Submit Your Application

- Once all sections are complete, review your details and submit your application.

- You’ll receive a confirmation with your application ID for tracking purposes.

This process is straightforward, but make sure you have all necessary documentation ready to speed things up!

Unity Bank Variable Personal Loan vs. Other Loan Options

The Unity Bank Variable Personal Loan offers a fairly standard set of features for borrowers, such as a variable interest rate, no-penalty extra repayments, and a redraw facility.

What sets it apart, however, is its streamlined online application process. Unlike many competitors, Unity

Bank provides an intuitive, step-by-step system that makes applying for a loan simple, even for those unfamiliar with financial jargon.

Why the Unity Bank Variable Personal Loan is a Great Choice (But There’s Always an Alternative)

The Unity Bank Variable Personal Loan offers a solid combination of flexibility and convenience, with features like no-penalty early repayments, a redraw facility, and an easy-to-navigate online application process.

It’s a dependable option for borrowers seeking straightforward terms and tools to manage their loan efficiently.

However, no financial product is one-size-fits-all. If you’re still exploring your options, consider Hume Bank Personal Loans, another reputable choice that might better align with your specific needs.

Take a moment to compare and find the perfect fit for your financial goals.

Ready to explore more? Check out Hume Bank Personal Loans right here on our site!

Hume Bank Personal Loans review

A personal loan with no monthly fees, free redraws, and flexible terms? See how Hume Bank Personal Loans stand out in the market.

Trending Topics

Capital One QuicksilverOne: Earn Unlimited 1.5% Cash Back Even with Fair Credit

See how QuicksilverOne gives you simple cash back every day, and $0 fraud liability, even with fair credit.

Keep ReadingYou may also like

Balance Transfer Credit Card Options to Apply in the UK

Cut high credit card interest and simplify your finances with balance transfer credit cards and debt consolidation strategies.

Keep Reading