Credit Cards

Latitude 28° Global Platinum Mastercard Review: Travel Light, Spend Smart

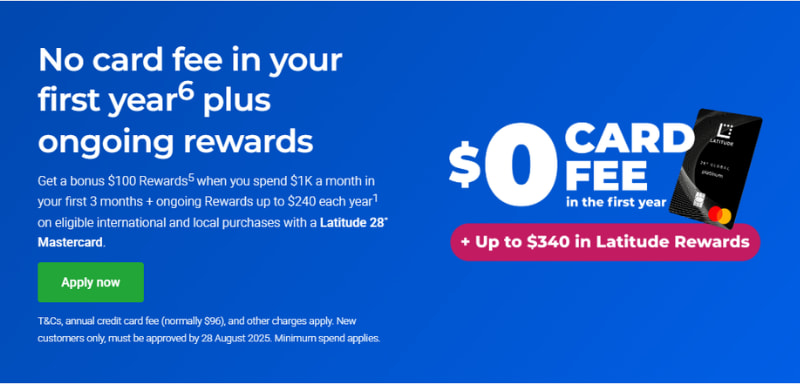

The Latitude 28° Global Platinum Mastercard is a travel-friendly credit card with no international transaction fees, free global data, and unique e-gift rewards.

Advertisement

Note: The information provided in this article is accurate at the time of publication but may be subject to change or cancellation by the card issuer.

Your Guide to One of Australia’s Most Travel-Friendly Cards

If you’re a frequent traveler or an avid online shopper dealing with international merchants, the Latitude 28° Global Platinum Mastercard might catch your attention.

Known for its lack of international transaction fees and currency conversion charges, this card aims to make global spending more economical.

Beyond its fee-friendly structure, the card offers features like complimentary global data roaming and purchase protection, enhancing its appeal to those constantly on the move.

Curious to see if this card aligns with your spending habits? Check this card’s features, benefits, and potential drawbacks.

| Key Takeaways ✨ |

|---|

| No international transaction or currency conversion fees |

| Complimentary global data roaming with Flexiroam |

| $10 e-gift card rewards for eligible monthly spending |

| Up to 55 days interest-free on purchases |

| $8 monthly fee after the first year |

The Essentials of Latitude 28° Global Platinum Mastercard: Key Features and Reliability

The Latitude 28° Global Platinum Mastercard is tailored for individuals who frequently engage in international transactions, whether through travel or online shopping.

Issued by Latitude Financial Services, a reputable non-bank lender in Australia, the card emphasizes cost-saving features over traditional rewards programs.

Key Features:

This card includes a range of features designed to help cardholders save while spending overseas or online with international retailers.

The focus here is on reducing unnecessary fees and giving users added peace of mind with protections and extras. Let’s break down the most important features that define the Latitude 28° Global Platinum Mastercard.

- No International Transaction Fees: Avoid the typical 2-3% fees on foreign purchases, making overseas spending more economical.

- Currency Conversion: Benefit from Mastercard’s competitive exchange rates without additional charges.

- Interest-Free Period: Up to 55 days interest-free on purchases, provided the balance is paid in full by the due date.

- Monthly Fee: $8 per month, totaling $96 annually, introduced from September 2024.

- Purchase Interest Rate: 27.99% p.a. on purchases; 29.99% p.a. on cash advances.

- Latitude Rewards: Earn a $10 e-gift card each statement period when spending $1,000 or more on eligible transactions.

- Global Data Roaming: Access 3GB of free data annually through Flexiroam in over 150 countries.

- Purchase Protection: Complimentary insurance covering loss or damage of purchases up to $1,500.

Latitude Financial Services, the card issuer, has a solid reputation in the Australian financial sector, offering various credit and loan products with a focus on digital solutions for customer convenience.

The Full Picture: Advantages and Disadvantages

Understanding the strengths and limitations of the Latitude 28° Global Platinum Mastercard can help determine its suitability for your financial needs.

The goods:

There are several compelling reasons why the Latitude 28° Global Platinum Mastercard appeals to travelers and international spenders.

Whether it’s about reducing extra costs or benefiting from convenience-oriented perks, these pros can offer great value depending on your lifestyle and spending patterns.

- No Foreign Transaction Fees: Ideal for travelers and online shoppers dealing with international merchants, saving on additional charges.

- Latitude Rewards Program: Provides tangible benefits through e-gift cards for consistent monthly spending.

- Global Data Roaming: Enhances connectivity for travelers with complimentary data access in numerous countries.

- Purchase Protection Insurance: Adds a layer of security for purchases against theft or damage.

- Digital Wallet Compatibility: Supports Apple Pay, Google Pay, and Samsung Pay for convenient transactions.

… and the “could be betters”:

Even a travel-friendly card has its trade-offs. While the Latitude 28° Global Platinum Mastercard offers valuable advantages, there are a few limitations to consider—especially if you don’t travel often or tend to carry a balance on your card. Here are the downsides you’ll want to be aware of.

- Monthly Fee: The $8 monthly charge may offset savings for those who don’t utilize the card’s international features regularly.

- High Interest Rates: With a purchase rate of 27.99% p.a., carrying a balance can become costly.

- No Traditional Rewards Program: Lacks points-based rewards, which may be a drawback for those seeking such benefits.

- Cash Advance Fees: Charges 3.5% or a minimum of $4 on cash advances, plus high-interest rates.

- Limited Travel Insurance: Does not offer comprehensive travel insurance, which some competitors provide.

Do You Qualify? Latitude 28° Global Platinum Mastercard Application Requirements

To be eligible for the Latitude 28° Global Platinum Mastercard, applicants must meet the following criteria:

- Age: At least 18 years old.

- Residency: Australian citizen, permanent resident, or temporary resident with the right to work in Australia and an intention to stay for at least 12 months.

- Income: While no specific minimum income is stated, a stable income source is essential.

- Credit History: A good credit score increases the likelihood of approval.

Required Documentation:

To complete your application for the Latitude 28° Global Platinum Mastercard, you’ll need to provide specific documents that confirm your identity, income, and address. Having these ready in advance can help speed up the process and improve your chances of approval.

- Proof of Identity: Driver’s license, passport, or proof of age card.

- Proof of Income: Recent payslips, tax returns, or bank statements.

- Proof of Residence: Utility bills or bank statements showing your current address.

Latitude 28° Global Platinum Mastercard: How to Navigate the Application Process

While applying for a credit card might sound like a chore, the process for the Latitude 28° Global Platinum Mastercard is designed to be clear, quick, and entirely digital.

Whether you’re an experienced cardholder or applying for your first travel-friendly card, it helps to know exactly what to expect at each step.

Here’s a detailed look at how to apply with confidence:

- Online Application: Start your application through the Latitude Financial website by completing the required form.

- Provide Documentation: Upload necessary identification and income documents.

- Credit Assessment: Latitude will assess your creditworthiness based on the provided information.

- Approval Notification: Applicants typically receive a response within 60 seconds; however, some cases may take longer.

- Card Activation: Upon approval, your card will be mailed to you. Activate it via the Latitude app or online portal.

But what about other options? Check the Citi Rewards Credit Card

If you’re considering alternatives, the Bankwest Zero Platinum Mastercard is another option worth exploring.

| Feature | Latitude 28° Global Platinum | Citi Rewards Credit Card |

|---|---|---|

| Foreign Transaction Fees | None | Yes (on international purchases) |

| Annual/Monthly Fee | $8/month ($96/year) | $199 annually |

| Purchase Interest Rate | 27.99% p.a. | 0% for 15 months, then variable |

| Rewards Program | $10 e-gift card with $1,000 monthly spend | Points per dollar on eligible purchases |

| Travel Insurance | Limited purchase protection | Includes mobile insurance, purchase protection, and discounts |

The Citi Rewards Credit Card, while having a higher annual fee, offers a more robust rewards system with points that can be redeemed for travel, gift cards, and more.

It also includes broader lifestyle perks like mobile phone insurance and exclusive travel discounts, making it attractive for those who want extra value beyond international spending benefits.

Citi Rewards Credit Card Review

Discover the Citi Rewards Credit Card: earn points, enjoy perks like phone insurance and cashback, and explore flexible redemption options.

Choosing the right credit card depends on your spending habits and financial goals. Evaluate the features that matter most to you, whether it’s saving on international fees, earning rewards, or having travel insurance coverage.

Trending Topics

Australian Military Bank Personal Loan review: Up to $75,000, apply online

Find out why the Australian Military Bank Personal Loan is a reliable choice for borrowing up to $75,000. No collateral required!

Keep Reading

NAB Low Fee Credit Card review: Say Hello to More Savings

Meet your new money-saving BFF! NAB Low Fee Credit Card has a $30 annual fee and up to 55 interest-free days. Perfect for savvy spenders!

Keep Reading

Balance Transfer vs Paying the Minimum: Which Option Saves You More Money?

Paying the minimum or using a balance transfer leads to very different outcomes. Learn how each option impacts interest and repayment.

Keep ReadingYou may also like

St. George Vertigo Credit Card review: Low-Interest Rate!

Find out if the St. George Vertigo Credit Card suits your needs. Explore key features, benefits, eligibility criteria, and application tips.

Keep Reading