Loans

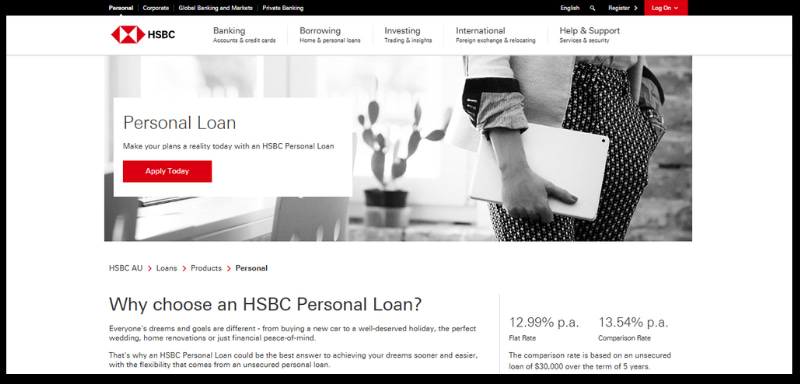

HSBC Personal Loan review: Affordable Rates, Maximum Benefits!

From fixed rates to quick applications, the HSBC Personal Loan stands out. Dive into our review to see its key benefits.

Advertisement

Disclaimer: The information provided here has been reviewed by the publisher as of the publication date. We recommend visiting the official website of the financial product and assessing your financial situation before applying for a line of credit.

2025 Financial Trends: How HSBC Personal Loan Keeps You Ahead

Life’s full of surprises—some great, some that come with a hefty price tag. Whether it’s fixing a leaky roof or finally taking that dream vacation, the HSBC Personal Loan could be your partner in making things happen.

In this review, we’ll dive into what makes this loan worth considering and how it stacks up against the competition. Spoiler alert: it might just be what your budget’s been waiting for!

Key Features: Know the HSBC Personal Loan

The HSBC Personal Loan is your go-to solution for tackling life’s biggest and smallest financial goals. Whether you’re planning a dream wedding, renovating your home, or consolidating debt, this loan is designed to provide support with clarity and convenience.

Here’s what makes it stand out:

- Fixed Interest Rates: Say goodbye to surprises with a predictable monthly repayment schedule.

- Loan Amounts That Fit Your Needs: Borrow between AUD 5,000 and AUD 50,000, perfect for various plans or emergencies.

- Flexible Terms: Choose repayment periods ranging from 1 to 5 years to match your budget.

The HSBC Personal Loan also boasts an easy online application process, often taking just 10 minutes to complete. Once approved, you could have funds in your account in a matter of days.

What’s more? There’s no need to offer collateral, and you’ll have the peace of mind knowing you’re backed by one of the world’s most trusted banks.

If simplicity, reliability, and tailored options sound appealing, the HSBC Personal Loan could be the financial tool you’ve been looking for.

Key Features Table: HSBC Personal Loan:

| Feature | Details |

|---|---|

| Loan Amount | AUD 5,000 to AUD 50,000 |

| Interest Rate | Fixed rate starting at 12.99% p.a. |

| Loan Term | 1 to 5 years |

| Fees | Establishment Fee: AUD 150; Monthly Fee: AUD 5; Early Repayment Fee: AUD 199 |

| Redraw Facility | Not available |

| Approval Time | Instant decision in 60 seconds; funds disbursed within a few days |

| Application Process | Online application; simple and quick (10 minutes to complete) |

HSBC’s Reputation and Trustworthiness

With over 150 years of history, HSBC stands as a global financial leader, trusted by millions worldwide. Known for its customer-focused approach, the bank ensures transparency, personalized solutions, and award-winning service.

HSBC adheres to strict international codes of conduct and is committed to sustainable and responsible banking. Choosing HSBC means partnering with a reputable institution that blends tradition with modern financial excellence.

Pros and Cons of Applying for an HSBC Personal Loan

Every financial product has its strengths and limitations. Here’s a straightforward breakdown of the HSBC Personal Loan to help you assess its fit for your needs.

The goods 👍:

- Predictable Payments: Fixed interest rates ensure stable monthly repayments.

- Wide Range of Loan Options: Borrow between AUD 5,000 and AUD 50,000 for tailored needs.

- Simple Application Process: Fast online application with instant decisions in many cases.

- No Collateral Required: Access funds without needing to pledge assets.

- Quick Disbursement: Approved funds are typically transferred within a few days.

- Global Trust: Backed by HSBC’s reputation for reliability and responsible banking practices.

…and the “could be betters”👎:

- Early Repayment Fee: Charges apply if the loan is repaid before the term ends (AUD 199).

- No Redraw Facility: Repaid funds cannot be accessed again, limiting flexibility.

- Eligibility Barriers: Requires a good credit history and minimum annual income.

- Monthly Maintenance Fee: A recurring AUD 5 fee adds to the overall cost.

By understanding these pros and cons, you can better decide whether the HSBC Personal Loan aligns with your financial objectives.

Who Is Eligible for this Loan?

Before you hit “apply,” let’s ensure you meet the requirements. Whether it’s your income, credit score, or residency, here’s everything you need to know to qualify:

- Age: 18 years or older.

- Residency: Australian citizen, permanent resident, or eligible visa holder.

- Income: Minimum annual income of AUD 40,000.

- Credit History: A good credit score is required.

- Documents: Valid ID and proof of income, such as payslips or bank statements.

If you tick these boxes, you’re ready to apply and enjoy the benefits of an HSBC Personal Loan!

How to Apply for an HSBC Personal Loan

Ready to turn your plans into reality? Applying for an HSBC Personal Loan is easier than you might think, and with a few key steps, you’ll be on your way to securing the funds you need. Follow this guide to get started:

Step 1: Check Your Eligibility

Before anything, ensure you meet the loan requirements like age, income, and credit history. Gather documents such as ID and proof of income for a smooth process.

Step 2: Use the Loan Calculator

Head to HSBC’s website to simulate your loan. Enter your desired amount and term to see estimated repayments. This helps you plan your budget.

Step 3: Complete the Online Application

Fill out the application form with details like personal information, income, and employment status. This step takes about 10 minutes and is entirely online.

Step 4: Submit Supporting Documents

Upload required documents, such as recent payslips or bank statements, to verify your eligibility.

Step 5: Receive a Decision

In many cases, you’ll get a response within 60 seconds. If approved, review and accept the loan terms.

Step 6: Funds Disbursed

Once accepted, the funds will typically be transferred to your account within a few days.

HSBC Personal Loan vs. Other Loan Options

The HSBC Personal Loan offers a trusted and efficient solution for various financial needs, with fixed rates and quick application approvals. Its clear repayment structure and streamlined process make it ideal for borrowers who value simplicity and reliability.

While competitors may offer lower rates or flexible features like redraw facilities, HSBC excels in providing a globally trusted brand and predictable payments. For those prioritizing speed, transparency, and a dependable lender, HSBC is a solid choice. However, borrowers seeking additional flexibility or higher loan amounts might explore other options.

Conclusion: Why the HSBC Personal Loan is a Great Choice (But There is Always an Alternative)

The HSBC Personal Loan shines as a reliable and efficient option for those looking to finance personal goals or consolidate debt. With fixed interest rates, a quick application process, and the backing of a globally trusted bank, it provides peace of mind and simplicity for borrowers.

However, if flexibility or additional features like a redraw facility are high on your priority list, the Bendigo Bank Personal Loan could be worth exploring. Offering competitive terms and added conveniences, it serves as a strong alternative for those with different financial needs.

Ready to discover more? Explore the Bendigo Bank Personal Loan and other options on our website today to find the perfect fit for your financial journey!

Bendigo Bank Personal Loan review

Pequeno resumo do post recomendadoGet the financial freedom you need with Bendigo Bank Unsecured Personal Loans. Explore loan amounts, rates, and features in our review!

Trending Topics

Bank of Melbourne No Annual Fee Credit Card Review

Get more from your credit card without the extra cost. The Bank of Melbourne No Annual Fee Credit Card is for budget-conscious users.

Keep Reading

Citi Rewards Credit Card Review: Big Points, Bright Perks

Discover the Citi Rewards Credit Card: earn points, enjoy perks like phone insurance and cashback, and explore flexible redemption options.

Keep Reading