Credit Cards

Bank of Melbourne No Annual Fee Credit Card Review

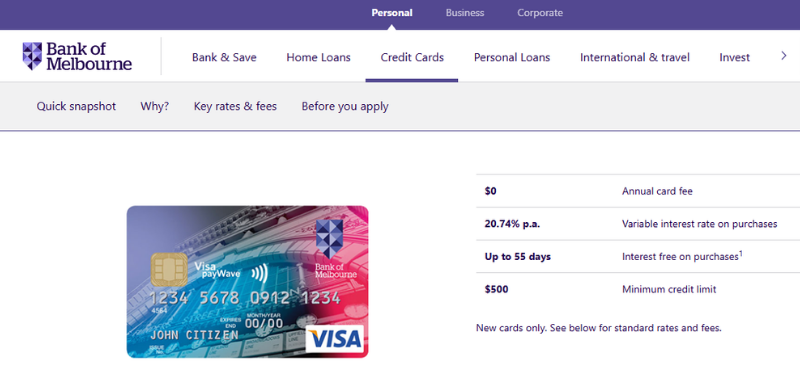

Why let fees eat into your budget? The Bank of Melbourne No Annual Fee Credit Card gives you the perks you need without the extra cost.

Advertisement

Note: The information provided in this article is accurate at the time of publication but may be subject to change or cancellation by the card issuer.

Save Money and Enjoy More Benefits

If you’re thinking about a credit card that frees you from annual fees, the No Annual Fee Credit Card from Bank of Melbourne might just be the perfect match for your wallet.

This card presents a practical everyday choice by eliminating those annoying annual fees.

Featuring a variable purchase interest rate of 20.74% per annum and offering up to 55 days without interest, it stands as an excellent option for those looking to cut costs.

| Key Takeaways ✨ |

| Experience the advantage of zero annual fees coupled with up to 55 days of interest-free purchases. |

| Transactions are subject to a variable interest rate of 20.74% per annum. |

| The card starts with a credit limit of $500 and allows for the inclusion of up to three extra cardholders without incurring additional charges. |

Moreover, with a starting credit limit of $500, this credit card is designed to serve a diverse clientele. It also offers the option to include up to three extra cardholders at no additional cost.

Its straightforward features make it a user-friendly option for managing your finances without the extra costs.

Diving into the credit card scene and curious about how the Bank of Melbourne’s No Annual Fee Credit Card holds up against its rivals?

Or maybe you’re keen to learn about the application process and the necessary qualifications?

Stick around as we reveal all the crucial information and insights that will enable you to make a decision that’s not only well-informed but also ideally suited to your financial situation.

The Essentials of Bank of Melbourne No Annual Fee Credit Card: Key Features and Reliability

The No Annual Fee Credit Card from the Bank of Melbourne stands out as an excellent selection for individuals aiming to minimize costs without sacrificing valuable benefits.

With no annual fee, this card emerges as a cost-effective solution for users.

Key Features

- Interest Rate: The card comes with a variable purchase interest rate set at 20.74% per annum, adjusting to market changes.

- Interest-Free Days: It provides the benefit of up to 55 days free from interest on purchases, which can be particularly helpful for managing short-term financial obligations.

- Credit Limit: New cardholders have access to a baseline of $500.

Additional Benefits

This card offers additional features such as:

- Additional Cardholders: Allows the inclusion of up to three extra cardholders without any additional fees, enhancing its suitability for families.

- Rewards and Offers: Based on current promotions, you could enjoy additional rewards or special offers, enhancing the card’s value.

Reliability of Bank of Melbourne

The Bank of Melbourne is a reputable and reliable issuer. Known for its customer service and commitment to providing solid financial products, you can trust that you’re in good hands.

The bank often updates its technology and services to ensure that cardholders have a seamless experience.

Is this card a good pick?

The advantages of the Bank of Melbourne No Annual Fee Credit Card are as enticing as one might imagine.

Say goodbye to yearly fees with a delightful $0 annual charge, enjoy the freedom of a lengthy interest-free span, and the convenience of including additional cardholders at absolutely no extra cost.

Its reliable issuer, the Bank of Melbourne, ensures you have a trustworthy and dependable financial partner.

This card is a strong option for those who want to manage spending without annual fees.

The Full Picture: Advantages and Disadvantages

The Bank of Melbourne No Annual Fee Credit Card comes with several perks, but it also has its drawbacks. Understanding both sides helps you determine if this card suits your financial needs.

The goods 👍:

- No Annual Fee: Enjoy the benefit of not paying any annual fees, saving money each year.

- Interest-Free Period: Take advantage of up to 55 days without interest on purchases, giving you extra time to pay your balance.

- Accessible Credit Limit: With a minimum credit limit of just $500, it’s easy for many to qualify.

- Worldwide Use: Suitable for international use, this card is a good option for travelers.

- Free Additional Cardholder: The option to add an extra cardholder at no cost makes it convenient for family use.

… and the “could be betters” 👎:

- Elevated Purchase Interest Rate: With a 20.74% per annum interest rate on purchases, it’s on the higher side.

- International Transaction Fee: A 3% fee on foreign transactions means extra costs for spending abroad.

- Modest Rewards Program: The rewards or points offered are less comprehensive than those of other cards.

- Balance Transfer Offer Conditions: The introductory 0% interest on balance transfers applies for 28 months, after which it shifts to a higher rate.

- Additional Fees to Consider: Despite no annual fee, charges such as the balance transfer fee may accumulate.

Do You Qualify? Bank of Melbourne No Annual Fee Credit Card Application Requirements

When applying for the Bank of Melbourne No Annual Fee Credit Card, you need to meet several eligibility requirements. Here are the key criteria:

Credit Score

Make sure your credit rating is healthy. Typically, a score of 620 or above is required for qualification.

Income Requirements

Having a stable income is essential. You may need a minimum annual income of $15,000. Keep all your income records handy.

Debt-to-Income Ratio

Strive to maintain a healthy debt-to-income ratio, ideally at 40% or below. This means keeping your overall debt within 40% of your income bracket, ensuring a balanced financial health.

Employment Status

Having a reliable stream of income is crucial. Whether you’re navigating the world of full-time employment, juggling part-time roles, or steering your own ship through self-employment, all these avenues are recognized as valid income sources..

Citizenship

To embark on this financial journey, you must hold the status of either an Australian citizen or a permanent resident, ensuring you’re eligible to apply.

Additional Tips

- Prior to application, review your credit report for any discrepancies. Identifying and rectifying any inaccuracies can significantly smooth your application process.

- Actively consolidating your debts can be a game-changer. By doing so, you lower your debt-to-income ratio, which is a critical factor in your application’s assessment.

- A steady employment track record is key. While life sometimes necessitates job changes, try to minimize frequent transitions. Lenders consider a consistent employment history to be an indicator of financial stability.

Bank of Melbourne No Annual Fee Credit Card: How to Navigate the Application Process

Applying for the Bank of Melbourne No Annual Fee Credit Card can be straightforward when you know the steps to follow. Here’s a helpful guide to assist you through the process efficiently.

Prequalification

Before you apply, make sure you meet basic qualifications. Check these points:

- You need to be of legal adulthood, which means being at least 18 years old.

- You should be an Australian resident.

- Have a regular income.

Gather Required Documents

It’s crucial to have all your documents ready. This ensures a smooth application. You’ll need:

- Identification: Either a Driver’s License or Passport

- Income Verification: Payslips or Bank Statements

- Employment Information: Details regarding your current job

Start Your Application

Go to the Bank of Melbourne’s official website and find the section dedicated to the No Annual Fee Credit Card. Select the “Apply Now” button, and you will be taken to the online application form.

Fill Out Application Form

Fill out every part of the form with attention to detail. The essential information you need to include consists of:

- Personal Information: Your complete name, date of birth, and ways to contact you.

- Financial Information: Your current employment situation, specifics about your income, and details of any debts you might have.

- Credit History: Details regarding any other credit cards or loans in your name.

Submit Your Application

Once you fill in all the details, submit the application online. Ensure you’ve double-checked all information for accuracy.

Review Process

After submission, the bank will review your application. They will assess your credit history and ability to repay.

Approval and Acceptance

If your application is approved, you’ll receive an offer. Here’s what to do next:

- Review the offer carefully, noting the interest rates and terms.

- Accept the offer by following the instructions provided.

Final Steps

After agreeing to the terms, your new credit card will be sent to you through the mail.

Follow the provided activation instructions, and then you’ll be all set to start using your Bank of Melbourne No Annual Fee Credit Card.

This guide should make the application process easier and ensure you provide all the necessary information. Happy applying!

But what about other options? Try the Bank of Melbourne Vertigo Credit Card

If you are curious about other options, the Bank of Melbourne Vertigo Credit Card might catch your interest. This card offers different features that could better fit your needs.

Here’s a quick comparison to help you decide:

| Feature | BoM No Annual Fee | BoM Vertigo |

| Annual Fee | $0 | $55 |

| APR | 19.74% p.a. | 13.99% p.a. |

| Credit Score Requirements | Good to Excellent | Good to Excellent |

| Credit Limit | $500+ | $500+ |

| Interest-free Days | Up to 44 days | Up to 55 days |

| Balance Transfer Offer | No | 0% for up to 28 months |

| Rewards Program | None | None |

Analysis

- Annual Fee: The standout benefit of the No Annual Fee Credit Card is its absence of an annual fee, presenting a clear financial advantage.

- APR (Annual Percentage Rate): The Vertigo Credit Card is more appealing for those who often have an outstanding balance due to its lower interest rate, potentially leading to significant savings.

- Interest-free Days: The Vertigo Credit Card offers a more generous period of up to 55 interest-free days on purchases, surpassing the 44 days provided by the No Annual Fee card, which can be beneficial for managing cash flow.

- Balance Transfer Offer: For individuals interested in transferring an existing balance, the Vertigo Credit Card becomes an attractive option with its 0% balance transfer rate for the first 28 months, offering a strategic way to manage debt.

Dive into the world of the Bank of Melbourne Vertigo Credit Card and uncover a treasure trove of features and benefits that could brilliantly elevate your financial toolkit!

Bank of Melbourne No Annual Fee card

Explore the advantages of the Bank of Melbourne Vertigo Credit Card. Enjoy low interest rates and other perks. Read our review for more!

Trending Topics

Bank of Melbourne Vertigo Credit Card review: Affordable Rates

Explore the advantages of the Bank of Melbourne Vertigo Credit Card. Enjoy low interest rates and other perks. Read our review for more!

Keep Reading

Beyond Bank Low Rate Personal Loan review: Borrow money for any purpose

The Beyond Bank Low Rate Personal Loan offers fixed rates and up to $200,000 in funding. Read on to see if it’s the right choice for you!

Keep ReadingYou may also like

Avant Credit Card Review: Credit Builder for Fair Credit Scores

Fair credit or limited history? Avant Credit Card makes credit accessible with simple approval and monthly reporting to credit bureaus.

Keep Reading

Qantas American Express Discovery Card Review: No Annual Fee

Fly high with the Qantas American Express Discovery Card. Learn about its no annual fee, rewards, and travel perks in our detailed review.

Keep Reading

Navigating the Path to Debt Freedom: A Strategic Guide

Master debt management with tips on budgeting, prioritizing high-interest debt, and creating an emergency fund.

Keep Reading