Loans

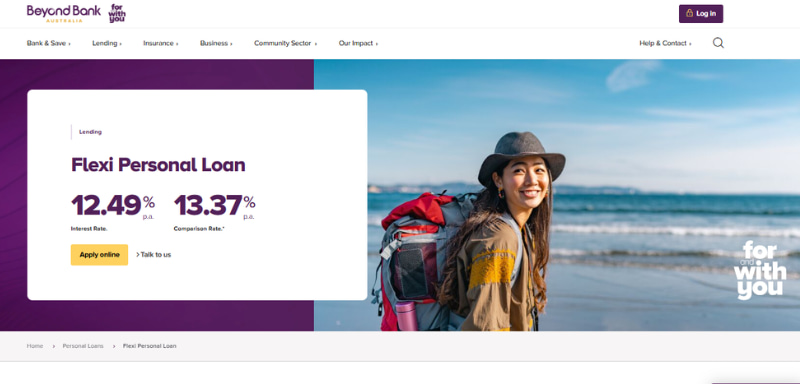

Beyond Bank Flexible Personal Loan review: A loan that fits you!

Can this loan handle your big plans or financial hiccups? Our Beyond Bank Flexible Personal Loan review gives you the inside scoop.

Advertisement

Disclaimer: The information provided here has been reviewed by the publisher as of the publication date. We recommend visiting the official website of the financial product and assessing your financial situation before applying for a line of credit.

How Beyond Bank Flexible Personal Loan Simplifies Your Financial Goals

Big dreams and sudden surprises have one thing in common—they often need a little extra cash to make them happen.

That’s where the Beyond Bank Flexible Personal Loan steps in. Whether you’re tackling lingering debts, financing a family celebration, or finally ticking that dream vacation off your bucket list, this loan is designed to adapt to your unique goals.

But is it really the right choice for you? Let’s dig into the details together so you can decide with confidence—and maybe even a smile—what your next financial move should be.

Key Features: Know the Beyond Bank Flexible Personal Loan

The Beyond Bank Flexible Personal Loan is designed to help you tackle life’s expenses, whether it’s paying off debt, funding a dream, or handling the unexpected. You can borrow between $5,000 and $75,000, with up to 7 years to pay it back. The fixed interest rate starts at 12.49% p.a., which keeps payments predictable, though it’s not the most competitive rate out there.

One perk is the ability to make extra repayments without penalty—perfect if you want to clear your debt faster. Plus, there’s a redraw facility in case you need to dip back into those extra payments. On the flip side, there’s a $195 setup fee and a $9 monthly fee, so be sure to budget accordingly.

Applications are online and quick, but approval hinges on meeting the bank’s credit requirements. While this loan offers some handy features, it’s always smart to shop around and see how it stacks up against other options.

| Feature | Details |

|---|---|

| Loan Amount | $5,000 – $200,000 |

| Interest Rate | Fixed rate starting at 12.49% p.a. (comparison rate: 13.37% p.a.) |

| Loan Term | 1 to 7 years |

| Fees | $195 establishment fee; $9 monthly service fee |

| Redraw Facility | Available for accessing additional repayments |

| Approval Time | Applications reviewed promptly, response time varies based on eligibility |

| Application Process | Online application with quick processing; support available for guidance |

Beyond Bank’s Reputation and Trustworthiness

Beyond Bank has made a name for itself by sticking to the basics: transparent policies, reliable service, and a customer-first approach.

As a mutual bank, it reinvests profits into better services, focusing on what customers truly need. Its dedication to ethical practices and open communication has built a foundation of trust.

Whether through financial education or accessible products, Beyond Bank aims to provide practical solutions without overcomplicating the process.

Pros and Cons of Applying for a Beyond Bank Flexible Personal Loan

Before you jump in, let’s take a closer look at the good and the not-so-good in this personal loan.

The goods 👍:

- Extra Repayments Without Penalty: Pay off your loan faster or reduce your interest costs with no extra fees.

- Redraw Facility: Convenient access to additional repayments if you need funds unexpectedly.

- Customizable Loan Terms: Borrow between $5,000 and $75,000 with repayment terms of up to 7 years, making it adaptable to different budgets.

- Fixed Interest Rates: Consistent monthly payments help you budget effectively.

- Online Application: A simple process that saves time and allows you to apply from anywhere.

- Customer Support: Access to lending specialists for personalized guidance during the application and repayment process.

- No Early Exit Fees: If you’re able to pay off your loan early, there’s no penalty.

…and the “could be betters”👎:

- Higher Interest Rates: Starting at 12.49% p.a., it may not be the most cost-effective option available.

- Fees Add Up: A $195 establishment fee and $9 monthly account fee increase the overall cost of the loan.

- Strict Credit Requirements: Applicants must meet Beyond Bank’s credit assessment criteria, which could exclude some borrowers.

- No Variable Rate Option: Fixed rates limit flexibility for those seeking potentially lower variable rates.

Who Is Eligible for a Beyond Bank Flexible Personal Loan? The Eligibility Criteria

Age Requirement: Applicants must be 18 years old or older.

Residency: You must be an Australian citizen, a permanent Australian resident, or a visa holder. For visa holders, the loan term must not exceed the validity period of the visa.

Income and Financial Assessment: A stable income is required, and Beyond Bank may assess your ability to service the loan based on your financial situation, including income and expenses.

Membership with Beyond Bank: By taking out this loan, you’ll automatically become a member of Beyond Bank Australia, effectively making you a part-owner of the bank.

Lending Criteria: The loan is subject to Beyond Bank’s lending criteria, which ensures applicants are financially capable of managing the loan responsibly.

How to Apply for a Beyond Bank Flexible Personal Loan

Ready to see if the Beyond Bank Flexible Personal Loan fits your financial needs? Applying for this loan is designed to be an efficient and transparent process.

Below, we’ll guide you through the steps to make your application as smooth as possible. Plus, we’ve included tips to boost your chances of approval.

Step 1: Calculate How Much You Need

Use Beyond Bank’s loan calculator to determine how much you can borrow and what your repayments might look like. This tool can help you balance what you need with what you can afford.

Step 2: Start Your Application Online

Kick things off by filling out the online application form—it only takes about 10 minutes. You’ll need to provide details about your income, assets, and expenses. Make sure to have recent financial documents ready to make this step faster.

Step 3: Speak to a Lending Specialist

Once your application is submitted, a Lending Specialist will contact you. They’ll confirm your eligibility, discuss the next steps, and answer any questions you might have about the loan or its terms.

Step 4: Provide Supporting Documents

To move your application forward, Beyond Bank will need to verify your financial situation. Be prepared to submit payslips, bank statements, and identification documents. Promptly providing these can speed up the process.

Step 5: Wait for Assessment and Approval

Beyond Bank will assess your application based on the information provided. Stay in touch with your Lending Specialist for updates and to address any additional requests quickly.

Step 6: Accept the Loan Offer and Sign the Agreement

If your application is approved, you’ll receive the loan terms and agreement. Carefully review everything before signing to ensure you’re comfortable with the terms.

Step 7: Receive Your Funds

Once the agreement is finalized, the loan amount will be transferred to your bank account, ready for you to use as planned.

Although the process is designed to be efficient and user-friendly, don’t hesitate to ask for help if you have any questions or difficulties.

Remember, when it comes to money, it’s better to ask as many times as necessary than to make an avoidable mistake.

Beyond Bank Flexible Personal Loan vs. Other Loan Options

The Beyond Bank Flexible Personal Loan offers reliable features like penalty-free extra repayments and a redraw facility, making it a practical choice for borrowers seeking flexibility.

While its interest rates and fees are slightly higher than some competitors, the fixed-rate structure provides predictable payments, ideal for budgeting.

Though it doesn’t stand out for cost-effectiveness, the loan’s simplicity and customer support make it a dependable option for those valuing transparency and ease of use. It’s a solid, no-frills choice for borrowers with straightforward financial needs.

Why the Beyond Bank Flexible Personal Loan is a Great Choice (But There’s Always an Alternative)

The Beyond Bank Flexible Personal Loan offers a dependable solution for borrowers looking for flexibility with features like penalty-free extra repayments, a redraw facility, and fixed-rate predictability.

However, it may not be the most cost-effective option due to its slightly higher fees and interest rates compared to similar products.

If you’re exploring alternatives, the Beyond Bank Low Rate Personal Loan could be worth considering. It offers lower rates while maintaining similar benefits, potentially providing better value for borrowers focused on minimizing costs.

| Feature | Beyond Bank Flexible Personal Loan | Beyond Bank Low Rate Personal Loan |

|---|---|---|

| Loan Amount | $5,000 – $200,000 | $5,000 – $200,000 |

| Interest Rate | Starts at 12.49% p.a. | Starts at 7.99% p.a. |

| Penalty-Free Extra Repayments | Yes | Yes |

| Redraw Facility | Yes | No |

If you’re looking for lower rates or a different loan structure, check out the Beyond Bank Low Rate Personal Loan on our website to see if it’s a better fit for your financial goals.

Beyond Bank Low Rate Personal Loan review

The Beyond Bank Low Rate Personal Loan offers fixed rates and up to $200,000 in funding. Read on to see if it’s the right choice for you!

Trending Topics

Wells Fargo Active Cash® Card Review: No annual Fee and Cash Back

A clear guide to the Wells Fargo Active Cash® Card with details on 2% cash rewards, no annual fee, and who should apply.

Keep Reading

Teachers Mutual Bank Personal Loans review: Flexible and Fee-Free Options!

Teachers Mutual Bank Personal Loans offer flexibility and transparency—find out if they’re the right choice for you in our review.

Keep ReadingYou may also like

SoFi Personal Loan Review: up to to $100,000!

Need a large personal loan fast? SoFi offers $5,000–$100,000, fixed APRs, no prepayment fees, and possible same-day funding.

Keep Reading