Credit Cards

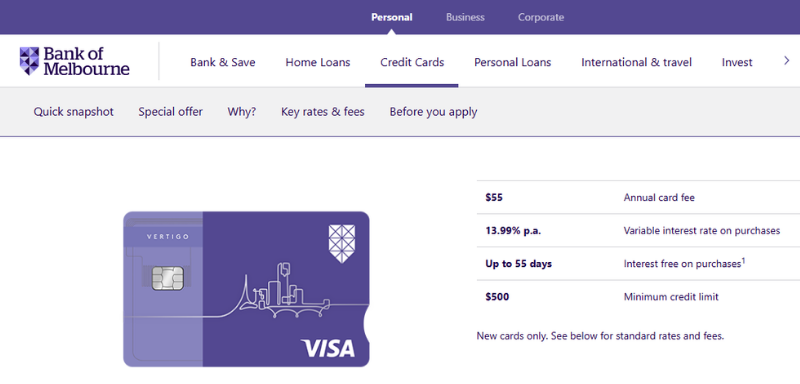

Bank of Melbourne Vertigo Credit Card review: Affordable Rates

Ready to take control of your finances? The Bank of Melbourne Vertigo Credit Card combines low interest rates with easy balance transfers to help you save more. Check out our full review to see if it’s the right fit for you.

Advertisement

Note: The information provided in this article is accurate at the time of publication but may be subject to change or cancellation by the card issuer.

Bank of Melbourne Vertigo Credit Card: Your Financial Superhero

Tired of credit cards that promise the moon but give you moon rocks? Meet the Bank of Melbourne Vertigo Credit Card – your new financial superhero, here to save your wallet and keep things effortlessly cool.

It’s got the low-interest rates of a savvy saver and the no-fuss credit balance migration option of a seasoned debt buster.

| Key Takeaways ✨ |

| Vertigo Credit Card features low-interest rates and a 0% credit balance migration offer. |

| Low annual fees and cashback options on some purchases. |

| Helpful tips on qualifying and navigating the application process. |

The Vertigo Credit Card isn’t just another piece of plastic; it’s a game-changer. Imagine this: a 0% credit balance migration offer for a whopping 28 months.

That’s two years and four months of breathing easy while you get your financial act together.

Plus, it comes with a low annual fee and the possibility of cashback on your daily spend – think of it as your wallet giving you a high-five every time you swipe.

Curious about how this card can revolutionize your daily grind? Stick around to discover all the juicy details, tips on nailing the application, and a few things to watch out for.

The Essentials of Bank of Melbourne Vertigo Credit Card: Key Features and Reliability

In a world full of mediocre, the Bank of Melbourne Vertigo Credit Card stands out like a rockstar at a karaoke night. It’s designed to help you save on interest and enjoy some killer perks.

Key Features:

- Interest Rate: Rock bottom at 13.99% p.a. on purchases – that’s less stress, more savings.

- Annual Fee: Just $55 – cheaper than your Netflix subscription binge-watching weekends.

- Credit balance migration Offer: 0% p.a. on credit balance migrations for up to 28 months. Apply by 31 July 2024 and you’re golden, though there’s a 1% credit balance migration fee.

- Interest-Free Period: Up to 55 days without interest on new buys when you pay your balance in full each month – a lifesaver for your spontaneous shopping sprees.

- Additional Cashback: Shop through the Bank of Melbourne Lounge with your Vertigo card and watch the cashback roll in.

Credit Limits and Payments:

- Credit Limit: Tailored to your creditworthiness and income.

- Minimum Payment: Either 2% of your closing balance or $10, whichever is more – simple and fair.

Reliability of Bank of Melbourne:

Think of the Bank of Melbourne as that friend who’s always got your back. Part of the Westpac Group, it’s rock-solid and ready to handle your financial needs with the care of a trusted confidant.

With its cocktail of low fees, competitive interest rates, and valuable rewards, the Bank of Melbourne Vertigo Credit Card is like the Swiss Army knife of credit cards – reliable, versatile, and just plain cool.

Whether you’re looking to save on interest or cash in on some sweet deals, this card’s got your name all over it.

The Full Picture: Advantages and Disadvantages

The Bank of Melbourne Vertigo Credit Card is like that stylish yet practical outfit – it looks good, feels great, but has a few quirks. Let’s break it down.

The Goods 👍:

- Low Interest Rate: At 13.99% p.a., it’s like finding an oasis in the desert of high interest rates.

- Introductory credit balance migration Offer: 0% p.a. on credit balance migrations for 28 months – it’s almost too good to be true, but it’s real.

- Interest-Free Days: Up to 55 days of no interest on purchases – perfect for strategic spending.

- Low Annual Fee: Just $55, making it easy on your wallet.

- Cashback Offers: Earn cashback on eligible spends at participating supermarkets and petrol stations, capped at $400 per card account.

… and the “Could Be Betters” 👎:

- Credit balance migration Fee: The 1% credit balance migration fee can sting a bit if you’re moving a big balance.

- No Rewards Program: No points for those frequent flyer miles, but hey, you’re saving elsewhere.

- Limited Extra Perks: Missing some fancy perks like travel insurance or purchase protection.

- Minimum Credit Limit: Starts at $500, which might not be ideal for high rollers.

- Introductory Offer Deadline: Only available if you apply by 31 July 2024 – so mark your calendar.

Do You Qualify? Bank of Melbourne Vertigo Credit Card Application Requirements

Think you’re ready to join the Vertigo club? Here’s what you need to qualify for this low rate card.

Minimum Credit Score: Your credit score should be around 650. If you’re not there yet, now’s the time to boost it.

Income Requirements: Stable income is key. The Bank of Melbourne usually looks for:

- Minimum annual income: $25,000 – $30,000.

- Proof of income through payslips or tax returns.

Existing Debt: Your debt-to-income ratio should be reasonable – ideally, your monthly debt payments shouldn’t exceed 30%-35% of your monthly income.

Employment Status: Steady employment is a plus. Full-time or part-time work is ideal, but if you’re self-employed, you’ll need extra documentation to prove your stability.

Citizenship and Residency: Applicants must be Australian citizens or permanent residents. Temporary visa holders might find it tough to get approved.

Tips for Increasing Approval Chances

- Check your credit report for errors and fix them.

- Reduce existing debts to improve your DTI ratio.

- Maintain steady employment and provide all necessary documents.

Bank of Melbourne Vertigo Credit Card: How to Navigate the Application Process

Obtaining a new credit card is easier with an intuitive process. It’s best if it’s online, and you do it from the couch at home.

Well, know that the process to obtain this Vertigo card is exactly like this. Don’t worry, we’ll take you step by step below:

Step 1: Check Your Eligibility

Ensure you meet the basic requirements:

- Be at least 18 years old.

- Hold a permanent residence in Australia.

- Have a good credit history.

- Have a stable income.

Step 2: Gather Your Documents

Prepare these documents:

- Proof of identity (passport, driver’s licence).

- Proof of address (utilities bill, rental agreement).

- Details of your income (payslips, tax return).

- Information on your expenses and liabilities.

Step 3: Apply Online

Visit the Bank of Melbourne website. Look for the Vertigo Credit Card and click “Apply now.”

Step 4: Fill Out the Application Form

Provide accurate details:

- Personal information (name, DOB, contact details).

- Employment details (employer’s name, position, salary).

- Financial details (assets, liabilities, credit card balances).

Step 5: Request a credit balance migration

If you want, request a credit balance migration:

- Enter details of up to 3 non-Bank of Melbourne credit cards.

- Note that the promotional rate applies for transfers requested at the time of application.

Step 6: Review and Submit

Double-check all entries. Ensure everything is correct to avoid delays. Click “Submit.”

Step 7: Application Review

Bank of Melbourne will review:

- Your credit history.

- Submitted documents.

- Financial obligations and income stability.

Step 8: Approval Notification

You will receive notification via email or SMS. If approved, your card will be sent to your address.

But what about other options? Check the ANZ Low Rate Credit Card

If you’re looking into credit cards, the ANZ Low Rate Credit Card might be an excellent alternative to the Bank of Melbourne Vertigo Credit Card. Let’s see how they stack up side by side.

| Feature | Bank of Melbourne Vertigo Credit Card | ANZ Low Rate Credit Card |

| Credit Score Requirements | Average to Good | Average to Good |

| APR (Interest Rate) | 13.99% p.a. | 13.74% p.a. |

| Credit balance migration Rate | 0% for 20 months | 0% for 20 months |

| Annual Fee | $55 (waived in the first year) | $58 (waived in the first year) |

| Rewards Program | Intro offer to get up to $400 cashback | No rewards program |

| Special Offers | Two intro offers to choose from | $250 back when you spend $1,500 in first 3 months |

Now that you know your options side by side, check out the post dedicated to the ANZ Low Rate credit card to make a well-informed decision and purchase the best card for you.

ANZ Low Rate credit card review

Enjoy financial flexibility with the ANZ Low Rate Credit Card. Low interest rates, easy application, and valuable perks. Learn more!

Trending Topics

NAB Low Fee Credit Card review: Say Hello to More Savings

Meet your new money-saving BFF! NAB Low Fee Credit Card has a $30 annual fee and up to 55 interest-free days. Perfect for savvy spenders!

Keep ReadingYou may also like

Bendigo Ready Credit Card review: ready, set, save!

Interested in a credit card with no annual fees and travel benefits? Check out our Bendigo Ready Credit Card review to see if it fits!

Keep Reading

Mastering Your Finances: Proven Strategies for Smart Debt Management

Transform your finances with 10 powerful debt management tips designed to help you tackle debt and stay on track.

Keep Reading

Westpac Altitude Rewards Black Credit Card review: Premier Travel Perks!

Travel smarter with the Westpac Altitude Rewards Black Card. Earn points, enjoy lounge access, and benefit from extensive insurance coverage.

Keep Reading